The Greene County Chamber of Commerce is dedicated to helping its business members during this challenging time. The following are resources that provide helpful information you may need to navigate through the current situation. We will be adding and updating this list as things develop.

Navigating the Road to Recovery – May 7, 2020

This document reviews ways that the Chamber can help your business navigate the road to economic recovery after a global pandemic. Click here to view document.

Verizon Wireless Business Solutions – May 7, 2020

Verizon Wireless is here to help your business through COVID-19. Click here to see how they can help.

My Benefit Advisor Solutions during the COVID-19 Outbreak – May 1, 2020

As the country continues to be impacted by the COVID-19 outbreak, employers and their employees have many questions on the potential impact. The following website is a hub for important client communication on the resources available to help you answer those questions. Click here for to view.

Pittsburgh Business Exchange Webinar – May 1, 2020

The Pittsburgh Business Exchange hosted a webinar featuring Dr. Kelly Hunt of Western PA District Director of the U.S. Small Business Administration. A recording of the presentation is now available for you to review online here.

Re-Opening Marketing Materials – April 30, 2020

As our businesses begin to reopen, we are here and ready to help! We can quickly handle your business’s marketing needs in this unprecedented time of change. Whether it’s signs to say you’re open, banners to show your appreciation, new take-out menu’s, or a digital campaign to set yourself up for growth—we want to help our fellow small businesses survive right now, so that we can thrive together when this challenge passes. Curbside pick-up and no contact delivery are available. Please contact us if there is something that we can do to support you and your business. Click here for more information.

What do Post-Coronavirus Events Look Like? – April 30, 2020

The most pressing question on event professionals’ minds is what events will look like once the lockdowns have been lifted. The following article explore some potential scenarios of the aftermath of Covid-19. Click here to read the article.

Energy Savings with World Kinect – April 30, 2020

Now more than ever, businesses are trying to save money. Remember as a Chamber member, you receive this great benefit with World Kinect Energy Services. Click here for more information.

Template for Responsible Re-Entry – April 30, 2020

What does the new “norm” look like? Responsible Re-entry for a business should be as personalized as your mission statement, your culture, your work force and the type or size of your business will be considerations when writing a re-entry plan and when determining when to move on to the next phase. Use this guide to help create a re-entry plan for your business.

Allegheny Conference on Community Development Webinar Series – April 27, 2020

Join us Thursday, April 30, from 4:00-5:00 p.m. for CEO perspectives on responding to COVID-19. Our guests will include: Farnam Jahanian, President, Carnegie Mellon University, Michael McGarry, Chairman & CEO, PPG, Hilary Mercer, Vice President, Shell Pennsylvania Chemicals & Shell Polymers. Click here to register.

Retail Industry Leaders Association’s Guide for Business Re-Opening – April 27, 2020

Open for Business – A Blueprint for Shopping Safe: Click here to view guide.

SBA Resumes Paycheck Protection Program Applications – April 27, 2020

Paycheck Protection Program Loan Information: The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities.

Who Can Apply

The following entities affected by Coronavirus (COVID-19) may be eligible:

- Any small business concern that meets SBA’s size standards (either the industry based sized standard or the alternative size standard)

- Any business, 501(c)(3) non-profit organization, 501(c)(19) veterans organization, or Tribal business concern (sec. 31(b)(2)(C) of the Small Business Act) with the greater of:

- 500 employees, or

- That meets the SBA industry size standard if more than 500

- Any business with a NAICS Code that begins with 72 (Accommodations and Food Services) that has more than one physical location and employs less than 500 per location

- Sole proprietors, independent contractors, and self-employed persons

To learn more about the Paycheck Protection Program and to apply, click here.

Direct Results Offering Protective Barriers for your Business – April 24, 2020

As you prepare your business for reopening, you might be thinking of ways to protect your employees and your customers. Direct Results has you covered offering barriers and partitions to help protect everyone from virus-containing droplets. Options include: Protective Counter Barrier, Workplace Partitions, Vinyl Wall Barrier. Call Direct Results for more information at 724-627-2040.

Chamber’s Recovery Communication Guide – April 22, 2020

Keep your customers updated with any changes with your business and keep them engaged during this time! Click here to view our guide.

Allegheny Conference Response + Recovery Webinar Series – April 20, 2020

This webinar features the most up-to-date information on unemployment from our public and private partners from the Pennsylvania Department of Labor and Industry, K&L Gates and Reed Smith. Click here to view.

Allegheny Conference on Community Development’s FAQ Guide to COVID-19 Financial Assistance – April 20, 2020

The Allegheny Conference on Community Development’s business community is convening digitally and giving guidance to the people and organizations that need tools and resources to get them through the COVID-19 crisis. The team has synthesized the top takeaways and answers to some of the most common questions we’ve heard from you during the the many webinars presented about how businesses can best access the resources and help that’s being offered. We broke these questions down into this FAQ guide. Click here to view the FAQ Guide.

Additional Information from Milinovich & Co., Inc. – April 20, 2020

Update on Tax filing deadlines: Be aware that the IRS has delayed the payment of 2nd Quarter 2020 tax estimates (normally due on 6/15) until July 15.

Additional Resources: Please visit the following IRS website to find the latest information about Covid-19 related tax and stimulus info: https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

Important Unemployment Update from Pam Snyder – April 20, 2020

The Pandemic Unemployment Assistance (PUA) is now available and accepting applications after it was delayed due to federal requirements. The state website has a lot of information about who is eligible for this new program, and what documents are required when filing an application. You can find that information here: https://www.uc.pa.gov/

Verizon Wireless Business Solutions Website – April 20, 2020

Many customers have made adjustments to their daily operations such as a work from home strategy. Know these are

trying times for everyone so it is important to make sure that your business is put in the best position it can be! These are the times that you can get more understanding on your account, plans, devices by doing a “Quarterly Business Review” (QBR) to make sure that your account is in the best position it can be for now and the future. Click here for more information.

Comcast Business Supporting business continuity with the right tools – April 20, 2020

As businesses take steps to stop the spread of COVID-19, like enabling work from home policies, we are finding new ways to keep your business moving forward — through virtual project management, business text messaging and collaboration tools, among other things. We’ve teamed up with other tech leaders and put together a list of resources to help you stay connected, productive, and secure.

USDA Tools to Help Rural Communities – April 15, 2020

U.S. Secretary of Agriculture Sonny Perdue unveiled a one-stop-shop of federal programs that can be used by rural communities, organizations and individuals impacted by the COVID-19 pandemic. The COVID-19 Federal Rural Resource Guide is a first-of-its-kind resource for rural leaders looking for federal funding and partnership opportunities to help address this pandemic.

Waynesburg University Remote Career and Wellness Resources – April 15, 2020

Remote Job and Internship Guide: Click here to view Wellness Resources: Click here to view.

Wellness Blog with Weekly Wellness Tips: Visit https://www.waynesburg.edu/

Allegheny Conference Response + Recovery Webinar Series – April 13, 2020

This webinar features PA Attorney General Josh Shapiro discussing the “PA Care Package” and his office’s effort to combat price gouging. Click here to watch.

National Association of Counties Resource Page – April 10, 2020

County response efforts and priorities – Click here to view

Summary of the CARES Act – April 10, 2020

Click here to view.

SBA COVID-19 Loan Programs Quick Guide – April 8, 2020

Click here to view the guide.

SBA Paycheck Protection Program Resources – April 8, 2020

Program Comparison: Paycheck Protection Program and Economic Injury Disaster Loan

Paycheck Protection Program FAQs

Paycheck Protection Program Checklist

5 Resources for Responding to COVID from the Allegheny Conference on Community Development – April 8, 2020

Click here to view the full list with links and resources.

1. Federal CARES Act – Paycheck Protection Program Guidance

2. Pennsylvania Resources – Employer Resources

3. Small Business Administration: $10,000 Advance & $2 Million Economic Injury Disaster Loans

4. Regional Expertise from Small Business Development Centers

5. Pittsburgh-Based Resources for Businesses

6. How You Can Help the Community

“Small Business-Focused COVID-19 Financial Assistance Options” Webinar Recording from the Allegheny Conference on Community Development – April 8, 2020

Click Here to view the recording. This webinar, along with others produced by Allegheny Conference on Community Development are archived on their website: Pittsburgh Region Response to COVID-19 site.

PACP Webinar Recordings with US Chamber – CARES Act – April 8, 2020

CARES Act Presentation – https://www.dropbox.com/s/hsx5drk3hwr5j06/CARES%20Act%20Presentation.pdf?dl=0

Webinar Recording – https://www.dropbox.com/s/kgyamxt8mbkal9p/PACPWebinar_USChamber_CARESAct_040720.m4a?dl=0

Coronavirus Resources for Pennsylvanians – US Senator Bob Casey – April 8, 2020

Click here to find resources to help you, your family, and your community navigate the challenges of this difficult time. This page is updated regularly. Senator Casey’s office remains ready to meet the needs of Pennsylvanians remotely. Should you need direct assistance, please contact the office either by phone at (202) 224-6324 or on his website here.

Pennsylvania Manufacturing Call to Action Portal – April 6, 2020

The Pennsylvania Department of Community & Economic Development – in collaboration with its strategic partners – wants to mobilize manufacturers that can produce critical medical supplies and products in response to the COVID-19 pandemic. If you are a current manufacturer of supplies and products or can pivot your existing manufacturing capabilities to meet the necessary demand, we want to hear from you.

Click here for more information.

List of benefits from the CARE Act for you and your business from Michael Milinovich of Milinovich & Co. – April 6, 2020

Click here to view.

COVID-19 Relief for All Current SBA 7(a) Borrowers – April 3, 2020

Do you currently have an SBA 7(a) loan that you are making payments on? If so, the SBA is providing some relief for you! Under the CARES Act, 7(a) Borrowers are relieved of any obligation to pay the principal, interest and any associated fees that are owed on a 7(a) loan in a regular servicing status (including Community Advantage loans) for a 6-month period beginning with the first payment due on a loan after March 27, 2020. SBA will pay this first loan payment to the Lenders within 30 days of the first loan payment due date after March 27, 2020. If a Lender receives a loan payment from a Borrower after March 27, 2020, the Lender must inform the Borrower that it has the option of the Lender either returning the loan payment to the Borrower or applying the loan payment to further reduce the loan balance after application of SBA’s payment. To make the first payment, SBA will need Lenders to provide the gross monthly loan amount due (that includes both the guaranteed and non-guaranteed portions of the loan) as soon as possible to the FTA. SBA will provide further guidance to Lenders on the method and the date by which Lenders must provide the gross monthly loan payment amount.

Any loan made before March 27, 2020 for which a deferment has been granted will still be eligible to receive the benefit of SBA making the loan payments for a 6-month period. Under the CARES Act, the 6-month period of SBA payments will begin at the end of the deferment period. Borrowers may voluntarily decide to end the approved period of deferment early to begin the 6-month period of SBA payments, and Lenders must inform Borrowers that it is their choice to either continue the deferment and begin receiving the SBA payments for 6 months after the period of deferment ends OR end the deferment early to begin receiving the SBA payments. Lenders should also be aware that the CARES Act authorizes SBA, through March 27, 2021, to waive the statutory limits on maximum loan maturities where the lender provides a deferral and extends the maturity of the loan.

FirstEnergy’s Pennsylvania Utilities Remind Residential Customers of Available Assistance Programs – April 3, 2020

https://greenechamber.org/wp-content/uploads/2020/04/09770480.pdf

PA Department of Community & Economic Development COVID-19 Resources for Life-Sustaining Businesses – April 2, 2020

- COVID-19 Business Guidance

- COVID-19 Business Risk Assessment Tool

- COVID-19 Business FAQ

- COVID-19 Business Fact Sheet

- Quarantine-Isolation Work Guidance

- Case, Contact, and Contact of a Contact Infographic

- Commonwealth of PA Critical Medical Supplies Procurement Portal

Kinetic Business Stepping Up to Help Small Business – April 1, 2020

Offering Free HD Meeting Service for 90 Days – https://businessblog.windstream.com/kinetic-business-stepping-up-to-help-small-business/

– 6 month forecast for working capital

– Make installment payments with creditors

http://hflapgh.org/coronavirusloan/

Small Business Owners Guide to the CARES Act – March 30, 2020

Click here to download.

Ogden Newspapers – March 30, 2020

Ogden Newspapers, the parent company of the Observer-Reporter, has established a $1 million fund to help local businesses get back to full strength by subsidizing local marketing efforts through matching advertising dollars.Businesses operating in the Southwestern Pennsylvania market can apply for a grant of $200 and up to $15,000. Applicants will receive a response to their application within one to two business days.

The fund is open to all locally owned and operated business impacted by the coronavirus whether or not they are current advertisers. Grant money can be used for local print and online advertising in the your local Ogden Newspapers publication (Observer-Reporter, Greene County Messenger, Herald Standard) between April 1 and June 30, 2020.

For more information and to apply, visit ogdennews.com/community-grant/.

Kinetic Business Stepping Up to Help Small Business – March 30, 2020

Kinetic Business is offering HD Meeting service free for 90 days if ordered by June 30.

This service is a voice and video collaboration tool that helps keep workers’ level of productivity high, while maintaining social distancing.

– Engage with remote workers through 1-on-1 or group meetings

– Share one application or your entire screen

– Easily work across all your devices through audio and video conferencing

Customers will receive new HD Meeting licenses at no charge for the first 90 days of service, then the standard billing rate of $9.99 per month will begin. HD Meeting service may be cancelled at any time. To sign up for this offer, please call 866.654.7014. Click the link for more information: https://businessblog.windstream.com/kinetic-business-stepping-up-to-help-small-business/

CARES Act Paycheck Protection Program:

The Coronavirus Aid, Relief, and Economic Security (CARES) Act allocated $350 billion to help small businesses keep workers employed amid the pandemic and economic downturn. Known as the “Paycheck Protection Program,” the initiative provides 100% federally guaranteed loans to small businesses who maintain their payroll during this emergency. Importantly, these loans may be forgiven if borrowers maintain their payrolls during the crisis or restore their payrolls afterward. https://www.uschamber.com/sites/default/files/023595_comm_corona_virus_smallbiz_loan_final_revised.pdf

An Update on COVID-19 Assistance: If your small business has been adversely affected by the recent events surrounding the COVID-19, HELP IS ON THE WAY. The PA Department of Community and Economic Development in conjunction with Greene County Industrial Developments, Inc. will be taking applications for the COVID-19 Working Capital Access Loan. Up to $100,000 – 0% interest on most loans* – One-year deferred payment – 3 year term – streamlined application and closing process – expedited turnaround – expedited funding *Ag Producers 2% interest, all other businesses 0% interest. If interested contact Greene County Industrial Developments, Inc at

[email protected]. Applications and information will be emailed as soon as available to interested small businesses. FINANCING IS FOR WORKING CAPITAL ONLY.

Southwestern Pennsylvania Commission created a resource guide to help businesses in need of assistance during the COVID-19 outbreak – Click here to view!

University of Pitt SBDC’s Resources & Relief for Small Businesses presentation – Click here to view!

March 20th , 2020

State Waiver for businesses questioning closure of non-life-sustaining businesses

The Administration has set up a waiver process. If you have a company that believes you should be considered a life-sustaining-business and would like to apply for a waiver, please email to one of the following:

- [email protected] : resource account to send questions about whether businesses need to close

- [email protected] : resource account if businesses want to apply for a waiver and want information on the process

Survey from the Allegheny Conference and Partners:

In order for the region to move ahead and to regain its footing from any implications from this pandemic, and to understand where companies are so we can identify opportunities for community support, we’re asking if you can please take our brief survey for us to understand how your company is challenged, develop insight into the regional economic implications, and plan for a course of action to support our region businesses and communities. https://www.surveymonkey.com/r/ACCD-Greene

WHS COVID Testing Update

Effective Thursday, March 19th

Please do not send your employees to WHS or any other healthcare provider to get them COVID tested as a condition for returning to work. The national and regional COVID testing supplies are extremely limited and this request will not be honored. Healthcare organizations are only testing patients (with a physician’s order) who meet the CDC guidelines for COVID testing.

If someone gets a physician order based on the CDC guidelines, here is where they can go for testing:

- Washington County Location: Wellness Way, Building 3, Suite 86 (near Wilfred R. Cameron Wellness Center) Monday through Friday – 8 am to 4 pm

- Greene County Location: WHS Medical Arts Building, Suite 100 (near the Washington Health System Greene facility) Monday through Friday – 8 am to 4 pm

At both locations listed above, patients stay in their car, and the WHS staff members walk out to the patient’s vehicle to conduct the swab test. Please do not send anyone to the Emergency Departments for COVID-19 testing ONLY.

All those individuals should go to the locations listed above.

Note: if they are having a true medical emergency, of course we’ll take care of them at the Emergency Departments. Again, please do not send employees to the Emergency Departments for COVID testing.

Families First Coronavirus Response Act: Signed into Law

Late on March 18, 2020, President Trump signed into law the Families First Coronavirus Response Act (which included some technical changes since the proposed bill was passed by the House). This appears to be just the beginning of major legislation related to COVID-19. Click here to continue reading the featured compliance document.

Click here for help on working remotely from Windstream.

Recording – PACP COVID-19 Resources Conference Call

If you weren’t able to join us, the call was recorded so that you can listen at your convenience. Follow the instructions below to listen to it on your phone: Dial (605) 313-5089, use Access Code = 480005 # and Recording Code = 76 #

3-Step Process to Disaster Loans – Click here for a step by step guide

Allegheny Conference on Community Development – Pittsburgh Region Response to COVID-19

This website includes consolidated resources made available from across our government, corporate, philanthropic, university and non-profit communities. This page is getting updated multiple times per day.

Fountainhead and SBA Coronavirus Recovery Loan Webinar – Click here for a replay of the webinar

COVID-19 and Unemployment Compensation (UC) Frequently Asked Questions (FAQ) – Click Here

Update from the Greene County Commissioners – click here

Webinar: Coronavirus Resources & Relief for Small Businesses

Friday, March 20 • 1:00PM: Representatives from the University of Pittsburgh Small Business Development Center, Huntington Bank, Maiello Brungo & Maiello, Wilke & Associates CPAs , Enscoe Long Insurance Group, and the U.S. Small Business Administration will present on the resources and relief options available to small business owners during this webinar. Topics to include: Pitt SBDC availability and resources; SBA Disaster Loan program and process; Working with your bank to discuss aid and relief; Families First Coronavirus Response Act; Tax implications resulting from business impact; Relevant insurance issues relevant for businesses A webinar link will be available prior to the event at entrepreneur.pitt.edu/events/covid-19-resources/.

Update from Governor Wolf

Wolf Administration Updates Businesses on Guidance for COVID-19 Mitigation Efforts

Updates from PA Chamber

List of Business Resources – Click Here

Updates from Small Business Administration (SBA)

SBA Disaster Assistance Resources

Pittsburgh Hebrew Free Loan Association

File an Initial Unemployment Claim

Resilience Checklist for Business Preparedness

Update from Pennsylvania Restaurant & Lodging Association

What Pennsylvania’s hospitality and tourism industry needs to know.

• Gov. Wolf ordered the statewide shutdown of all non-essential stores for at least two weeks. This order includes the closure of restaurants and bars dine-in services. Delivery and take-out are permitted for all restaurants and customers may enter the establishment to pay for a takeout order. However, if you have outdoor seating, that counts as part of the restaurants and is NOT permitted.

•Your employees can apply for unemployment compensation at uc.pa.gov.

•Further, while the federal government is working on legislation that would allow for reimbursement of paid leave and paid family leave, as of this time, that is only if an employee is sick or quarantined because of COVID-19. That legislation does not currently apply to the forced shutdown of businesses, which is happening in PA right now.

•For more information, visit www.prla.org/coronavirus

The Greene County Chamber seeks to provide access to recommendations, regulations, services and expertise to its members. During the COVID-19 pandemic, this mission remains constant. Prior to acting, members should consult their own professional advisors for information and counsel specific to the individual and unique situations faced by organizations, individuals and corporations. The opinions, interpretations and recommendations of the Greene County Chamber are informational only and should not be relied upon by the recipient as legal or professional advice. The Greene County Chamber makes no representations as to the accuracy or reliability of the content contained herein. Users of this information accept any and all risks associated with the use of such information and agree that the Greene County Chamber has no liability to user.

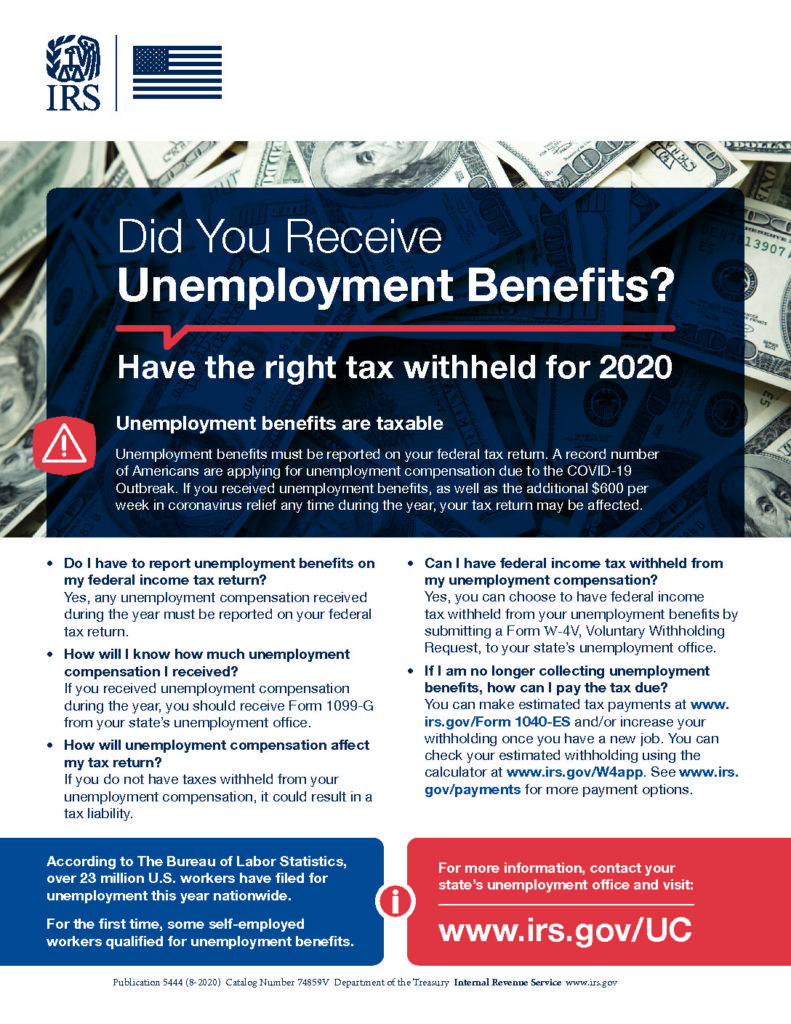

Helpful information for the upcoming tax season: